Managing rental properties comes with a long list of responsibilities, from tenant relationships to maintenance issues. With all those tasks, staying on top of property accounting can often take a back seat—but it’s crucial for running a successful rental business. That’s why we’re tackling two critical questions for you: What is a rent roll, and why is it important? A rent roll provides a snapshot of your rental income and clearly shows current and projected revenue.

This key tool simplifies income tracking and supports better financial planning, property performance evaluation, and goal setting. Let’s explore REI Hub’s rent roll report, why it’s essential, and how REI Hub can make managing your rental finances easier.

What is a rent roll?

At its most basic level, a rent roll is a rent payment report.

In other words, rent rolls are itemized reports of income generated by a rental property or portfolio. They offer a quick view of revenue and occupancy status, and whether the report covers a single property or multiple units, rent rolls help landlords stay organized and informed.

Key Elements of a Rent Roll

- Property name or address

- Unit name or number (if applicable)

- Monthly rent per unit

- Annual rent per unit

- Total monthly and annual rent for the portfolio

Some rent rolls also include details like tenant balances, additional fees owed, or lease terms.

Did you know? Rent rolls are vital for landlords of all types, whether managing residential, commercial, or mixed-use properties.

How Rent Rolls Benefit Landlords

Rent rolls serve multiple purposes throughout the rental life cycle, from evaluating potential properties to managing finances effectively.

1. Evaluate Potential Properties

Thinking about buying a rental property? The rent roll helps you evaluate gross rents and compare them to local market rates. This comparison can reveal whether the property’s rents are competitive or offer room for adjustments to improve profits.

Lenders also use rent rolls to assess income potential. A strong rent roll showing steady revenue and occupancy can increase your chances of securing financing for purchases or refinancing.

2. Track and Manage Rent Payments

The rent payment report summarizes each tenant’s payment status. It helps you track who has paid rent and who is overdue so you can issue reminders or assess late fees when necessary.

This report combines all payment details to make it easier to track tenant payments and spot problems. With this information, you’ll be able to address payment issues quickly and maintain consistent income from your rental units.

3. Assess Tenants and Property Managers

Rent rolls are useful for evaluating both tenants and property managers:

- Potential tenants: Candidates can provide a rent roll with proof of on-time payments to stand out and speed up the approval process.

- Current tenants: Use the report to review current tenants’ payment histories. Consistent late payments may indicate it’s time to reconsider renewing their lease.

- Property managers: High turnover rates or frequent late payments could signal issues with your property management firm, tenant screening process, or the property itself. If your current manager isn’t enforcing late fees or addressing payment problems, it may be time to find a new one.

4. Resolve Tenant Disputes

Disagreements over rent owed or payment dates are common in property management. A rent roll provides a documented history of tenant payments, offering clear, objective evidence in case of disputes. This transparency can help clarify misunderstandings or support eviction proceedings if needed.

5. Plan for Future Expenses

A rent roll gives you real-time insights into your rental income, helping you forecast cash flow and prepare for periods of reduced income or increased expenses.

Consider these questions:

- Are late payments affecting your cash reserves?

- Do gross rents cover operational costs and savings goals?

- How will upcoming lease expirations affect your income?

-

- Will the unit sit empty while you make updates and screen candidates?

- Will you renew the lease at higher rates?

With these insights, you can plan for repairs, upgrades, or lease adjustments to maintain steady revenue.

6. Generate Financial Reports

Rent rolls form the foundation for key financial reports like income statements and cash flow analyses. By summarizing rent collection data, you can manage these tasks:

- Tracking revenue trends

- Identifying budget variances or cash flow issues

- Assessing the financial health of your properties

This data helps you make informed decisions and improve your property’s performance.

7. Prepare for Taxes

Accurate income reporting is essential for avoiding issues with the IRS. Monitoring rent roll data ensures you accurately report rental income, simplifying tax preparation. If audited, a rent roll can serve as supporting documentation for reported income.

Time-saving tip: REI Hub has a built-in Schedule E report so that you can prepare your tax returns easily and confidently.

8. Support Investment Decisions

Analyzing rent payment reports over time helps you assess property performance and identify areas for improvement. Use information from this report for your key performance indicators to get insights into your business and answer these questions:

- Are rents increasing, decreasing, or holding steady?

- Is the property meeting income expectations?

- Should you adjust rents, change tenants, invest in updates, or consider selling?

Pro tip: When selling a rental property, provide potential buyers with a rent roll to show the property’s income potential. This information can increase buyer confidence and speed up the sale process.

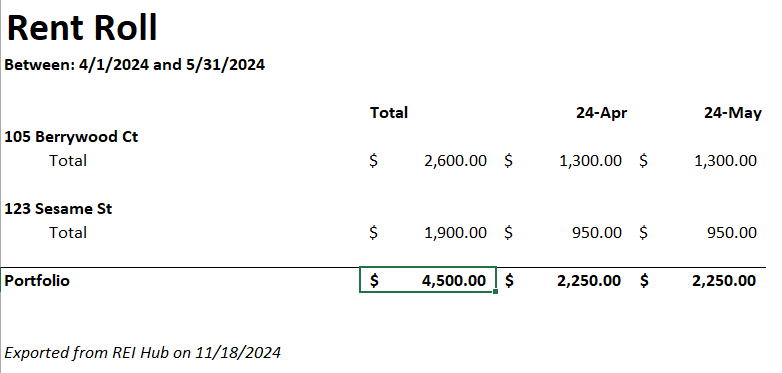

Generating Rent Roll Reports with REI Hub

REI Hub offers rental property owners a suite of accountant-approved tools to manage finances effectively, including streamlined rent rolls. With our platform, you can

- Link accounts: Securely import payment data to ensure accurate reporting.

- Generate reports: Create rent rolls for any date range to review up-to-date information.

- Track expenses: Use additional features to monitor income, expenses, and property performance.

Our rent roll reports make decision-making easier, whether you’re planning for tax season or evaluating your portfolio.

Ensure Accurate Reporting with Rental Accounting Software

In addition to rent roll reports, REI Hub provides a complete bookkeeping solution tailored for landlords. We designed our platform specifically for rental property, so you have all the key features needed to keep accurate books:

- Bank reconciliation: Confirm your accounts are complete, accurate, and reliable.

- CPA-approved reports: Generate financial statements at the property or portfolio level.

- Document storage: Keep receipts and lease documents organized.

- Fixed asset tracking: Monitor depreciation and asset values.

- Integration partners: Save time with seamless connections to platforms like TurboTenant and RentRedi.

- Mobile app: Update records on the go.

- U.S.-based support: Get help when you need it.

- User-friendly platform: Streamline bookkeeping with our simplified design—no accounting degree needed.

All these tools are included at no extra cost, making REI Hub a budget-friendly choice for managing your rental business.

Take Control of Your Rental Finances

Landlords need rent rolls to stay organized, track income, and make informed decisions. With REI Hub’s cloud-based accounting software, managing rent rolls—and your rental finances as a whole—is simple and efficient.

Try REI Hub for free today—no credit card required! Sign up now to ensure your rental property finances are always accurate and ready for tax season.