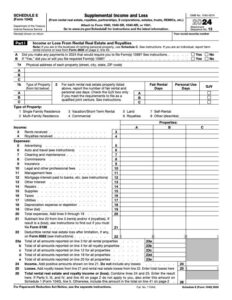

Understanding the Schedule E for Rental Properties

Schedule E is a supplemental part of Form 1040, the US Individual Income Tax Return. Most real estate investors use this form to report passive income and expenses from their rental properties. This overview will help you determine whether Schedule E applies to your situation. Then, we’ll walk through the elements of Part I that apply to rental properties.

Who uses Schedule E?

In 2024, 9.72 million taxpayers own rental property, but they won’t all use the same tax form. How you structure your real estate investment business determines which form you need.

Generally, you will use the Schedule E in these situations:

- You own rental property in your own name, with your spouse, or through a single-member LLC.

- Rental real estate activity owned through partnerships or S corporations use IRS Form 8825.

- You are not a real estate professional.

- Real estate professionals work half their time or more in real property trades and make a specific tax election.

- You do not provide additional, substantial services to your tenants.

- If you provide tenants with substantial services, such as including meals, guided activities, or daily cleaning, you likely need to file Schedule C.

As always, we recommend contacting a tax professional for advice about your particular filing requirements and status.

Learn more and get the most recent version from the IRS here.

1099s

The first section of Schedule E concerns 1099 forms. Generally, businesses must file Form 1099-NEC if they’ve made more than $600 in payments to one or more independent contractors.

How you pay independent contractors determines which 1099 form they will receive. Cash and check payments are reported on 1099-NEC, which you or your CPA would prepare. However, electronic payments—think credit cards, PayPal, or Venmo—are reported on 1099-K, which the payment processor issues.

If you are filing 10 or more 1099 forms of the same type, you must e-file. The IRS deadline for Form 1099-NEC is January 31st.

Fair Rental Days

After entering your property’s address and type, you will enter the number of fair rental days and personal use days. The IRS uses these values to determine whether the property was used as a home—and whether your expenses are tax deductible.

Generally, the property counts as a home if your personal use exceeds 14 days or 10% of the total days you rented your home to others at a fair price. Even if the IRS doesn’t count the property as your home, note that expenses related to personal use days are not deductible.

Fair rental days refer to the number of days that the unit was actually rented out—not the total time it was available to be rented.

Did you know? If you rent out your home for 14 days or less per year, you don’t need to report that rental income.

For more information about renting residential and vacation properties, refer to IRS Topic no. 415.

Qualified Joint Venture

This box, abbreviated as QJV, is used by spouses who

- each materially participate in and collectively own a real estate business,

- file a joint tax return, and

- elect to be treated as a QJV.

Simply owning rental properties with your spouse does not qualify you for this election. If you and your spouse own and operate a real estate business through an LLC, that doesn’t qualify for the QJV election either.

A full discussion of the QJV election is available here.

Where to Find Your Income and Expenses

As an owner, you are responsible for tracking the income and expenses related to your rental activities. Your CPA or tax-preparation software will then use your records to file Schedule E as part of your return.

The income and expense information needed to complete Schedule E will come from several places.

- The statements from your business bank account are a transaction history of money received or expenses incurred.

Pro tip: All the activity for your rental properties should run through your business accounts. Combining personal and business transactions in one account is one of the top errors we see in real estate accounting.

- Property managers or property management software should track monthly operating income and expenses.

- In January, banks will send a 1098-B statement summarizing the deductible interest paid on mortgages during the prior year.

- Your records, which should contain your receipts as well as information on any other deductible business expenses that you’ve paid for out of pocket.

You must total up the figures from these sources plus any other revenues and expenses related to your properties.

Staying organized is critical to maximizing your tax deductions. Don’t wait until tax time to review your documentation or work on your books. Use accounting software or a spreadsheet to maintain your financial records year-round.

Income and Expense Categories

Schedule E includes income and expense categories common to owning rental properties.

On the income side, all revenues are classified as rent received (Line 3). This includes all money received as part of your rental business activities, including rent payments, application fees, tenant fees, pass-through utility payments, and security deposits withheld.

Red flag alert: Reportable income is one of the biggest sources of disputes between the IRS and taxpayers—and rental income can act as a red flag for auditors.

The expense side goes into more detail, with each expense category listed separately on lines 5–19:

- Advertising

- Auto and travel

- Cleaning and maintenance

- Commissions

- Insurance

- Legal and other professional fees

- Management fees (rental agencies and property management companies)

- Mortgage interest paid to banks

- Other interest

- Repairs

- Suppliers

- Taxes

- Utilities

- Depreciation expense or depletion

- Other

You can deduct these expenses from your rents received, so make sure you have included every applicable item. Otherwise, you will pay taxes on more net income than you actually received.

Need a complete breakdown of what goes in each category? Check out our related article, “Auditing Schedule E Income and Expense Categories.”

The Rest of the Schedule E Form

Schedule E is used to report other kinds of supplemental income in addition to rental property. Part I of the form deals with rental real estate (which this article focuses on) and royalties, while Parts II–IV report different sources of passive income and loss. Part V summarizes the preceding sections.

How REI Hub Can Help

Without clear, organized financial records for your rental property, you’ll have trouble filing an accurate Schedule E. That’s why it’s so important to use an accounting system to keep your books in shape throughout the year—and that’s where REI Hub comes in.

We designed our accounting software specifically for real estate investors like you. With our platform, you can easily import the transactions for your rental property, monitor CPA-approved reports, and generate a Schedule E report.

We even offer resources like the Tax Review to help you double-check your books as you prep for tax time.

You don’t need to waste time manually calculating your rental income and expenses—or worrying about spreadsheet formulas. We’re here to simplify bookkeeping and tax time for you and your rental property business. Sign up for our free 14-day trial today!