There are many reasons for putting a personal property into service. A home may be difficult to sell, or you’d like to keep it for personal use in the future. Perhaps you’d like to monetize some unused space in your home, so you decide to try house hacking. Or you convert part of your home to a home office to take advantage of tax deductions. No matter why you put your property in service, depreciation becomes a factor once you convert your space, so you need to know its basis.

Since depreciation isn’t an option for personal property, you may not have thought about your property’s basis or depreciation calculations before. Working out basis and depreciation amounts are multistep processes, but the REI Hub team is here to walk you through them. Today, we’ll cover the basics of basis, depreciation, and their calculations for three types of personal property in service.

What Is Basis?

According to the IRS, basis means “the amount of your capital investment in property for tax purposes.” The amount you paid for your property, including any debt you took on to buy it, is the foundation of your basis. But other outlays can add to your basis too:

- Closing costs paid by the buyer

- Legal fees

- Recording costs

- Sales taxes

- Seller debts paid by the buyer

- Transfer taxes

- Title insurance

- Some items don’t count toward your basis. Leave these costs out:

- Appraisal payments

- Charges related to refinancing a loan

- Credit report fees

- Mortgage insurance premiums

- Rent for tenancy before closing

Over time, you may make improvements to your property. Or you may deal with damages to your home. Both situations can affect your basis. We account for these changes when we calculate an adjusted basis.

How to Calculate Basis

We need to know a property’s basis before we can calculate other figures. Your annual depreciation amount depends on your basis. If you have any casualty losses, your insurance company will need to know the property’s basis. When you sell a property, its basis helps determine your gain or loss. The basis is a key figure in real estate, so we want our calculations to be as accurate as possible.

Determining your property’s basis is a two-step process.

Step 1: Collect Your Information

To calculate your basis, you’ll need information about your home. Gather these figures to get started:

- Total purchase price of your home: Look on your closing statement for this number.

- Value of the land when you bought your home: Your property assessment, closing statement, or property tax bill should have this listed.

- Fair market value of your home when put into service: For this figure, use the sales price of similar houses sold around your in-service date, then subtract the land cost from the price.

- Full cost of any whole-home improvements: If you made a capital improvement after you bought the house, and the improvement applied to the entire dwelling, make note of those costs. Think about fixed assets like a new roof or HVAC unit.

- Any casualty losses related to your home that lowered its value: According to the IRS, casualty losses range from damages to the total loss of your property as a result of any sudden, unexpected, or unusual event. This includes damage from floods, hurricanes, and other natural disasters. The loss figure will be either the adjusted basis of your property or the decrease in your property’s fair market value resulting from the casualty.

Once you have these five figures, you can calculate the adjusted basis of your home.

Step 2: Calculate the Adjusted Basis

To determine your property’s adjusted basis, use this formula:

Purchase price of home − Land value + Improvements − Casualty losses = Adjusted basis

Next, compare your adjusted basis to the fair market value of your property. Remember to leave the land’s value out of the fair market value. Then use whichever number is less as the basis for your property’s depreciation.

The formula for calculating basis is simple, but accuracy is critical. When you’re not sure if a cost should count toward your basis, talk with your tax preparer.

What Is Depreciation?

Taxpayers can’t deduct the entire cost of a fixed asset in one year, but you can claim depreciation. This is an annual noncash expense that helps you recover the costs of assets over time. And it lowers your yearly tax liability.

The lifespans of fixed assets range from five to 39 years, so you’ll need to track depreciation for each of your assets. Don’t let the short lifespan ranges put you off, though. Once you’ve reached the end of the taxable lifespan, the asset is fully depreciated. You’ll stop deducting depreciation for it, but you can still use the asset.

For an in-depth look at depreciation, check out our related article: Rental Property Asset Depreciation.

How to Calculate Depreciation

The type of asset you have determines how you calculate your property’s depreciation. For this article, we’ll focus on three situations: whole-home rentals, house hacks, and home offices.

Depreciation for Whole-Home Rental Properties

The IRS depreciates residential rental property over 27.5 years. The depreciation calculation is simple when you rent out an entire property.

Adjusted basis of rental property ÷ 27.5 = Annual depreciation for your rental property

All residential rental property uses a midmonth convention. This means you treat all property as if you placed it in service (or disposed of it) at the midpoint of the month.

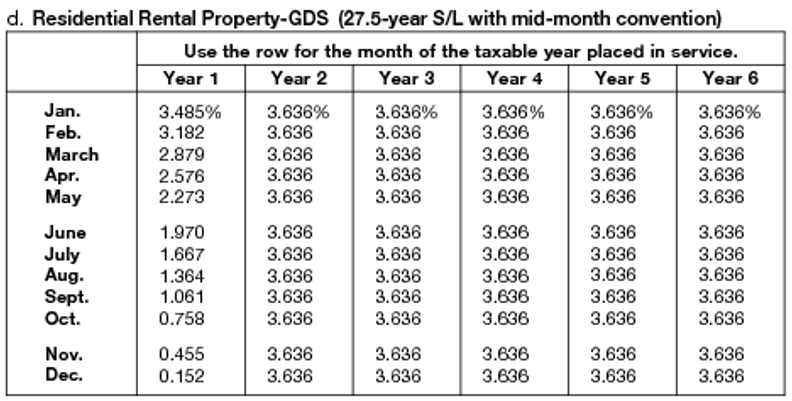

Note that depreciation for your first and last year will be different. IRS Table 2-2d shows the percentage of depreciation you can take depending on the month you put the property in service. You’ll only use this chart the first and last year for your property’s depreciation deduction.

Depreciation for House Hacks

Depreciation only applies to the rental portion of any property. So for a house hack, start by determining what percentage of the home is for personal use versus rental use. Then use the formula below to work out the depreciable value of your rental space.

Adjusted basis of the property × Rental use percentage = Depreciable value of rental portion

For example, let’s say you buy a duplex and rent out one unit while living in the other. Fifty percent of the property is for rental use. The adjusted basis of the property is $350,000, and we’ll multiply that by 50 percent. The depreciable value of the rental portion is $175,000. We’ll use that figure to calculate the annual depreciation amount.

Depreciable value of rental portion ÷ 27.5 = Annual depreciation for your house hack

For our duplex example, the annual depreciation amount is $6,363.63.

Keep in mind that the depreciation varies in the first and last year. Use IRS Table 2-2d to help you calculate your first and last years’ depreciation.

Depreciation for Home Office Space

The IRS treats a home office as nonresidential rental property, so it depreciates over 39 years. Here’s the calculation:

Adjusted basis ÷ 39 = Annual depreciation for your entire home

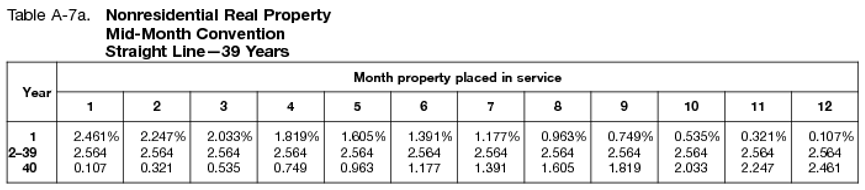

Like whole-home rentals and house hacks, your depreciation for the first and last year will be different. Use IRS Chart A-7a that shows the percentage associated with the month you started using a home office. You’ll only use this chart the first and last year you take the home office deduction.

When you have your home’s annual depreciation figure, then you’re ready to calculate the amount related to only your home office (the business percentage). Use this formula:

Square footage of your office space ÷ Total square footage of your home = Business percentage

Finally, to get your annual home office depreciation expense, multiply your yearly depreciation figure by your business percentage.

Takeaways

When you put your personal property in service, you can deduct depreciation on your taxes. But to do that, you must know the basis of your property. The calculations aren’t difficult, but accuracy matters. When you aren’t sure if a cost should count toward your property’s basis, ask your CPA. Once you have your adjusted basis, use it to figure out your annual depreciation for the business portions of your property. This is crucial whether you have a whole-home rental, a house hack, or a home office. Depreciation lowers your tax liability, so take advantage of this deduction opportunity!

At REI Hub, we understand how important your depreciation deductions are. That’s why we include a depreciation reminder as part of our Tax Time Double-Check. Plus, we have a built-in fixed asset schedule to help track your asset balances and depreciation. Ready to make the switch to accounting software designed for rental property owners? Sign up for a free trial today!