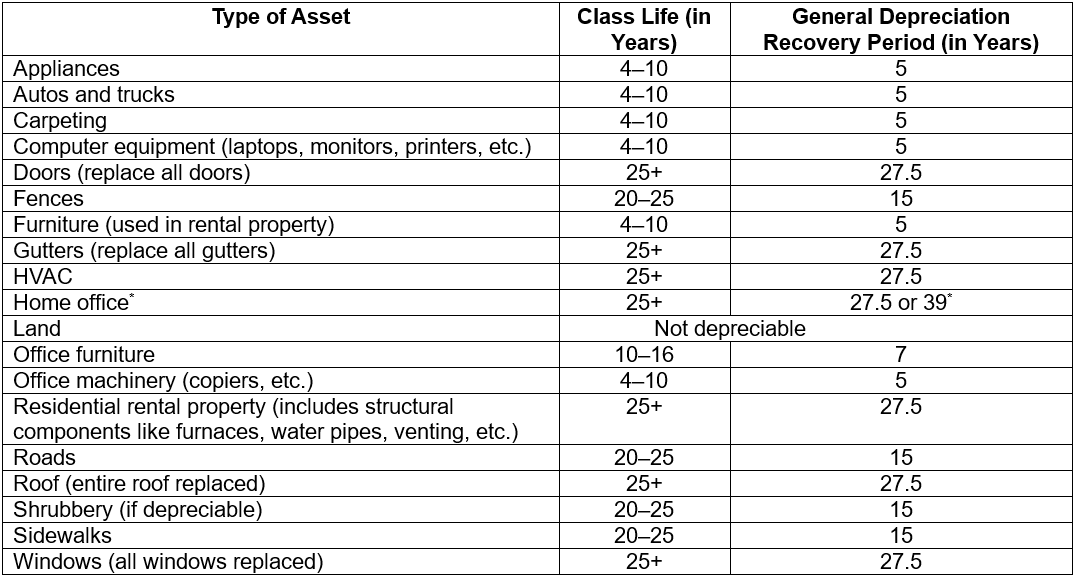

Before rental property owners can calculate their depreciation for the year, they must determine an asset’s class life and recovery period, which are set by the IRS. We’ve put together a table showing common rental property assets and improvements along with their expected lifespans and recovery periods. Use this as a quick-reference guide when you’re tracking your assets and working on your depreciation calculations.

Glossary

Before you dive into the table, let’s clarify a few terms.

- Assets (or fixed assets) are tangible, long-term items used in the continuing operation of a business.

- Class life is the IRS’s estimate of the average useful life of the asset. The IRS has a specific class life for each type of asset.

- Recovery period is the number of years over which you recoup the cost or basis of an asset. The recovery period is determined based on the depreciation system used.

Asset Class Life and Recovery Periods

Notes on Class Life and Recovery Periods

Home Offices

*The recovery period for your home office depends on what sort of residence you live in. Do you live in a personal-use single-family home? If you use part of it as a home office, you’ll depreciate that part of your home as nonresidential real property with a recovery period of 39 years.

Is your home an apartment in a building you own and operate as residential rental property? If so, then you’ll depreciate the part used as an office as residential rental property with a recovery period of 27.5 years.

Assets Not Listed in the Tables

Don’t see the asset you’re searching for in the table? If it isn’t listed in IRS publication 946 Appendix B either, check with your tax preparer. Typically, any assets without a specified class life automatically have a seven-year recovery period under the General Depreciation System or 12 years under the Alternative Depreciation System.

Depreciation Methods

The IRS requires real estate investors to use the Modified Accelerated Cost Recovery System (MACRS) to depreciate rental property placed in service after 1986. Plus, you must use the General Depreciation System to depreciate your property unless you elect or are specifically required by law to use the Alternative Depreciation System. The General Depreciation System is the default choice for most rental property owners because of the shorter recovery periods and possibility of bonus depreciation.

Related Reading

For more information on rental property assets and depreciation, refer to our related resource articles: